2023-24 Proposed Budget: Impact on California’s Older Adults and People with Disabilities

summary

On January 10, 2023, Governor Gavin Newsom released California’s 2023-24 proposed budget. The proposal includes program changes that impact services for older adults and people with disabilities.

Date Updated: 01/25/2023- budget,

- california,

- complex care,

- coordinated care,

- dual eligibles,

- ltss,

- master plan for aging,

- person-centered care,

Overview

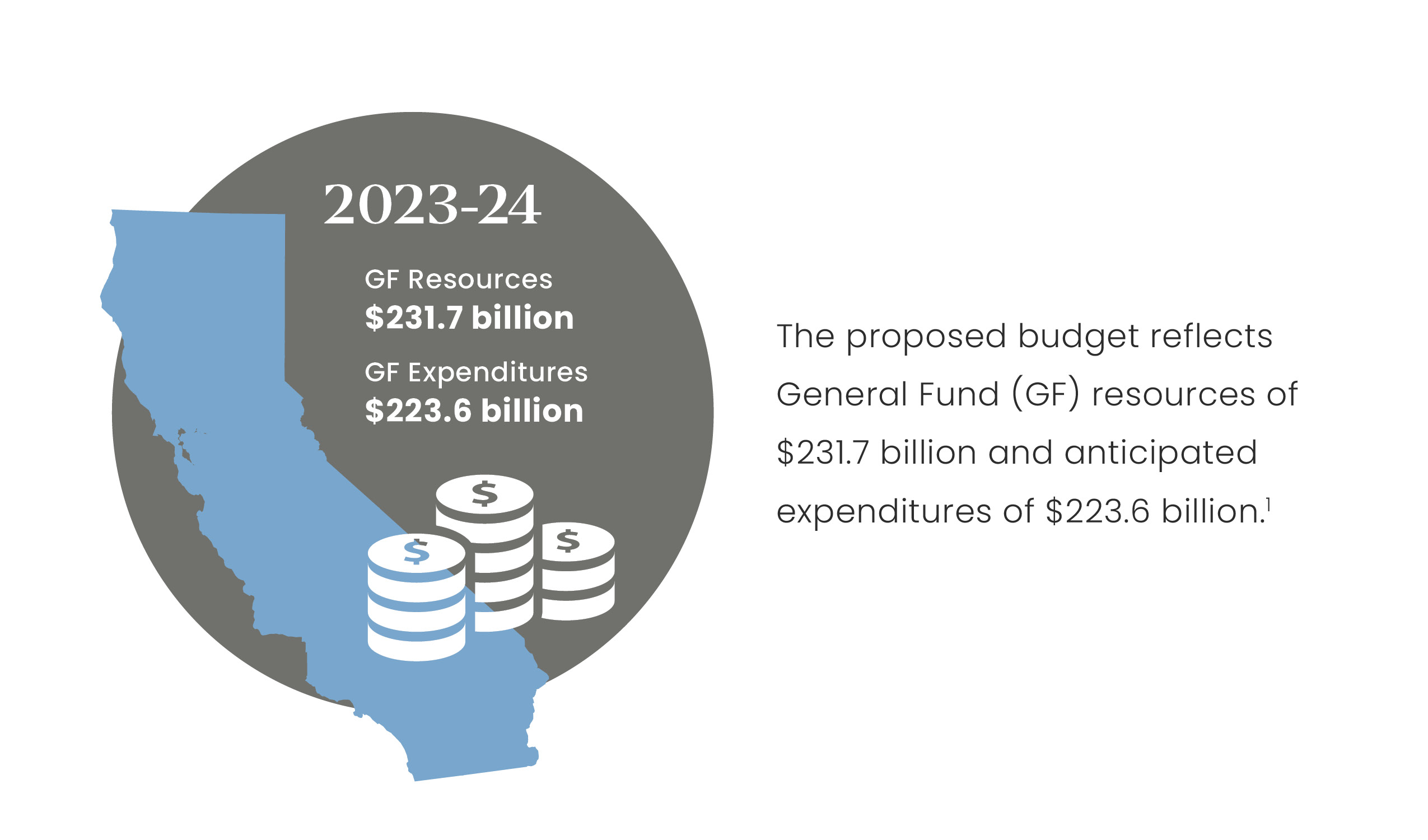

On January 10, 2023, Governor Gavin Newsom released California’s 2023-24 proposed budget, outlining the state’s projected revenues and spending plan for the fiscal year beginning on July 1, 2023, and ending June 30, 2024. The state’s budget affects Californian’s quality of life, including older adults, people with disabilities, and family caregivers. The state’s major operating fund, referred to as the General Fund (GF) consists of undesignated revenues.2 The GF has three primary sources of revenue including personal income taxes, sales and use taxes, and corporation taxes. In addition to the GF, there are several hundred funds designated for specific purposes.2 The proposed budget includes total GF resources of $231.7 billion and anticipated expenditures of $223.6 billion, with the rest held in reserve.

The proposed budget reflects a Safety Net Reserve balance of $900 million, and a Budget Stabilization Account or “Rainy Day Fund” balance of $22.4 billion. Budget stabilization funds allow the state to set aside surplus revenues for use during unexpected deficits. This account is at its constitutional maximum of 10% of GF revenues, which requires that the remainder ($951 million) be spent on infrastructure investments such as rail and transit projects, high-speed rail, ports, and walking and bicycling projects.1,3,4

The proposed budget forecasts GF revenues will be $29.5 billion lower than the 2022 Budget Act projections, with the state facing an estimated budget gap of $22.5 billion in the 2023-24 fiscal year.3 Despite the imminent deficit, there are no significant cuts to health and social service programs serving older adults. However, the budget does propose certain spending delays and shifting of expenses to other funding sources outside the state’s general fund. If there are further declines in state revenue, the administration has indicated that reserve funding might be utilized, and additional cuts could be proposed in the May Revise.

Governor Newsom’s 2023-24 proposed budget outlines his top priorities for the year ahead, focusing on the state’s most underserved communities. The proposal addresses homelessness, affordable housing, workforce issues, climate change, economic security, and other initiatives that impact older adults and people with disabilities.

Master Plan for Aging

Since the release of the Master Plan for Aging (MPA) in January 2021, California has made unprecedented investments to help older adults, caregivers, and people with disabilities. There are 23 strategies and over 200 initiatives tracked in the new Implementation Tracker that align with goals in the MPA: (1) Housing for All Ages and Stages; (2) Health Reimagined; (3) Inclusion and Equity, not Isolation; (4) Caregiving that Works; and (5) Affording Aging.5 On January 20, 2023, the MPA Second Annual Report was released with 95 new initiatives for implementation in 2023-24.

While there was no explicit mention of new MPA activities in the proposed budget, it does maintain most of the investments made in the past two years, including planning, capacity building, infrastructure development, program expansion, and data collection. Although this reinforces the state’s commitment to ensuring person-centered, equitable care in health, housing, and social supports, the potential budget shortfall limits additional funding and one-time allotments to continue MPA implementation.

California’s 2023-24 Budget: Impact on Older Adults, People with Disabilities, and Family Caregivers

Governor Newsom’s 2023-24 budget maintains previous MPA commitments to programs and services that support older adults, despite a projected revenue shortfall of $22.5 billion. The proposed budget identifies trigger cuts, reduces planned one-time spending, and delays or defers previously authorized investments. This approach preserves $35.6 billion in state reserves.3

In the 2022 Budget Act, significant health investments were made to expand access to Medi-Cal, implement California Advancing and Innovating Medi-Cal (CalAIM), and create other health-related programs. The proposed budget protects significant investments, which are outlined in Table 1 below. In addition, the state will request federal approval to renew California’s Managed Care Organization (MCO) tax and use the proceeds to offset $6.5 billion in GF spending to maintain Medi-Cal funding for three years.3,7

| Table 1: Health Care Affordability and Access 3,6,7 | ||

| Item | Action | 2023-24 Proposed Budget |

| CalAIM | Continues the long-term commitment to transform and strengthen Medi-Cal, including managed care for dual eligibles | Approximately $10 billion |

| Medi-Cal Community-Based Mobile Crisis Services | Maintains implementation of the 24-hour mobile crisis intervention services as a Medi-Cal behavioral health benefit | $1.4 billion ($335 million GF) over five years, starting in 2022-23 |

| Medi-Cal Expansion | Expands Medi-Cal to an estimated 700,000-plus eligible adults ages 26-49 regardless of immigration status, providing coverage for immigrants with disabilities by January 2024 | $844.5 million ($635.3 million GF) |

Table 2 reflects maintained, modified, and reduced investments to long-term services and supports (LTSS).

| Table 2: Long-Term Services and Supports 3,6,7 | ||

| Item | Action | 2023-24 Proposed Budget |

| Care In-Home Supportive Services (IHSS) | Maintains funding for IHSS to eligible low-income individuals age 65 or older, or with disabilities, to remain safely in their homes and prevent more costly institutionalization | $20.5 billion ($7.8 GF) |

| Modernizing the Older Californians Act | Modifies the investment approved in the 2022 Budget Act to disperse $186 million in funding over five years, instead of three, for pilot programs supporting community-based services programs, family caregiver supports, the Senior Volunteer Department, and aging in place | $37.2 million annually across five years starting in 2022-23. |

| Home- and Community-Based Services (HCBS) | Reduces the HCBS Spending Plan approved in the 2021 Budget Act to enhance, expand, and strengthen HCBS initiatives across six Health and Human Services departments | $60 million reduction |

California continues to experience a shortage of affordable housing for low-income older adults. While the budget proposal maintains funding for investments in homelessness, there are no

additional investments in affordable housing development. In addition, the Accessory Dwelling Unit (ADU) Program approved in the 2022 Budget Act to provide $50 million one-time GF reimbursement grants for the construction of ADUs has been temporarily eliminated. If there are sufficient budget revenues, it will be restored in January 2024.

Table 3 highlights new and maintained investments that could directly impact older adults and people with disabilities.

| Table 3: Housing and Homelessness 3,6,7,8 | ||

| Item | Action | 2023-24 Proposed Budget |

| CalAIM Transitional Rent Waiver | Provides up to six months of rent or temporary housing for individuals transitioning out of institutional care to prevent homelessness | $6.3 million GF (increases to $40.8 million GF in 2025-26) |

| Homeless, Housing, Assistance, and Prevention Program (HHAP) | Funds grants through HHAP for cities, counties, and continuums of care to create local plans to address the challenges of homelessness | $1 billion GF |

| Returning Home Well Program | Creates transitional housing for parolees, 25% percent of whom are over the age of 50 | $10.6 million GF annually for three years starting in 2022-23 |

| Veterans Housing and Homeless Prevention Program | Augments funding for the Veterans Housing and Homeless Prevention Bond Act of 2014 to support veterans’ housing needs | $50 million GF |

In the last two years, there have been significant investments to address health care workforce shortages. While investments in the health and human services workforce were maintained, there are proposed cuts and deferments as outlined in Table 4.

| Table 4: Workforce and Volunteer Infrastructure 3,6 | ||

| Item | Action | 2023-24 Proposed Budget |

| Health and Human Services Workforce | Strengthens and expands the state’s health and human services workforce by increasing funding for additional nurses, community health workers, social workers, and behavior health workers | $1 billion GF |

| Public Health Workforce Reduction | Reduces funding for public health workforce training and development programs by $49.8 million GF over four years | Maintains $47.4 million GF over four years |

| Health Care Access and Information (HCAI) Workforce Programs | Defers investments in HCAI health care workforce programs to be appropriated in 2024-25 and 2025-26 | Defers $68 million from 2022-23 and $329.4 million in 2023-24 |

The proposed budget makes a key investment to assist California’s most underserved populations. Table 5 identifies the increased cash assistance to help low-income older adults and people with disabilities meet basic needs and living expenses.

| Table 5: Economic Security 3 | ||

| Item | Action | 2023-24 Proposed Budget |

| Supplemental Security Income (SSI)/State Supplementary Payment (SSP) | Increases cash assistance to individuals with disabilities and older adults in the SSI/SSP program by 8.6% | Over $1 billion GF |

Next Steps in the Budget Process

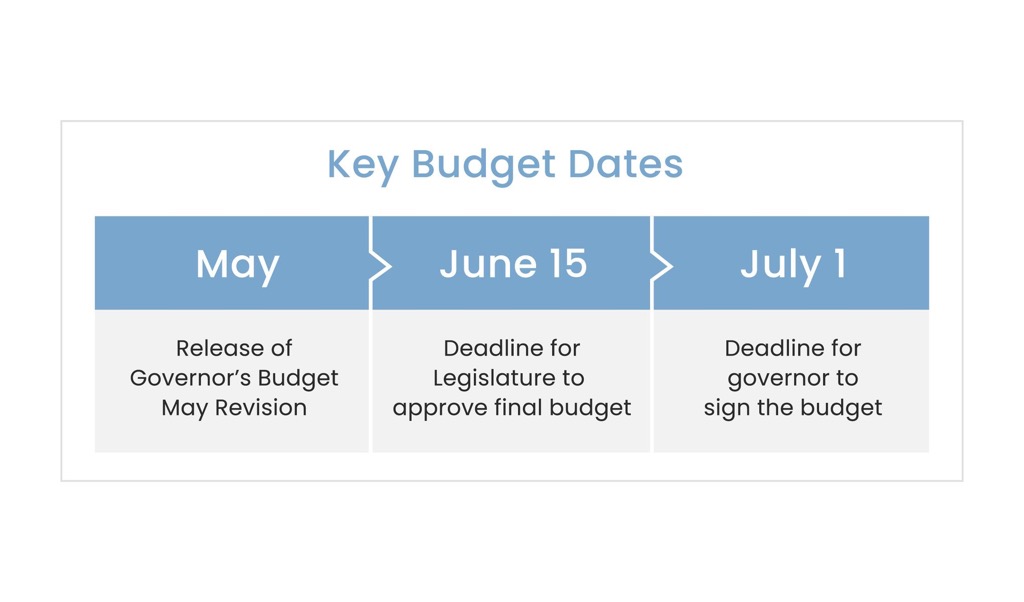

California’s 2023-24 Governor’s Budget requires approval by the Senate and the Assembly. The Legislature will deliberate the budget through a series of budget subcommittee hearings in each house from March through May.9,10

In May 2023, the governor will release an updated revenue forecast, referred to as the “May Revision,” which accounts for changes in revenues and proposed changes to expenditures within the January budget. Each subcommittee votes on its respective issue area(s) in the budget and submits a report to the full budget committee for a vote. From the floor, each house’s budget bill is referred to a joint budget conference committee where differences between the houses can be resolved. The conference committee votes on a compromise version, which if passed, is sent to the floor of each house simultaneously.9

By law, the Legislature must approve the budget by June 15 in time for the governor to sign it by July 1. California’s constitution requires a majority (50% percent plus one) vote of each house of the Legislature and a forfeiture in pay to legislators if the budget is not enacted by the June 15 deadline. Finally, the governor has the authority to “blue pencil” (reduce or eliminate) any appropriation contained in the budget.9

Download the publication for all visuals and complete references.

Continue Reading

This policy brief establishes a basis for the critical system transformation activities necessary to produce a high quality, person-centered system of care for older adults and people with disabilities.

This fact sheet provides the background and context for California’s Coordinated Care Initiative (CCI), established as part of the enacted 2012-2013 budget. It outlines the changes to the delivery of medical care and longterm services and supports (LTSS) for individuals eligible for Medicare and Medi-Cal as well as Medi-Cal-only seniors and people with disabilities initiated by the CCI.

This is the third report coming from the California Medicaid Research Institute (CAMRI) project entitled: Comprehensive Analysis of Home- and Community-Based Services in California. The report describes Medicare and Medi-Cal spending for those beneficiaries using long-term services and supports funded by Medi-Cal.