On May 14, 2020, California Governor Gavin Newsom released the May Revision of the 2020-21 proposed budget. The revision includes cuts to and elimination of critical home- and community-based services that impact the state’s most vulnerable older adults, people with disabilities, and family caregivers.

Overview

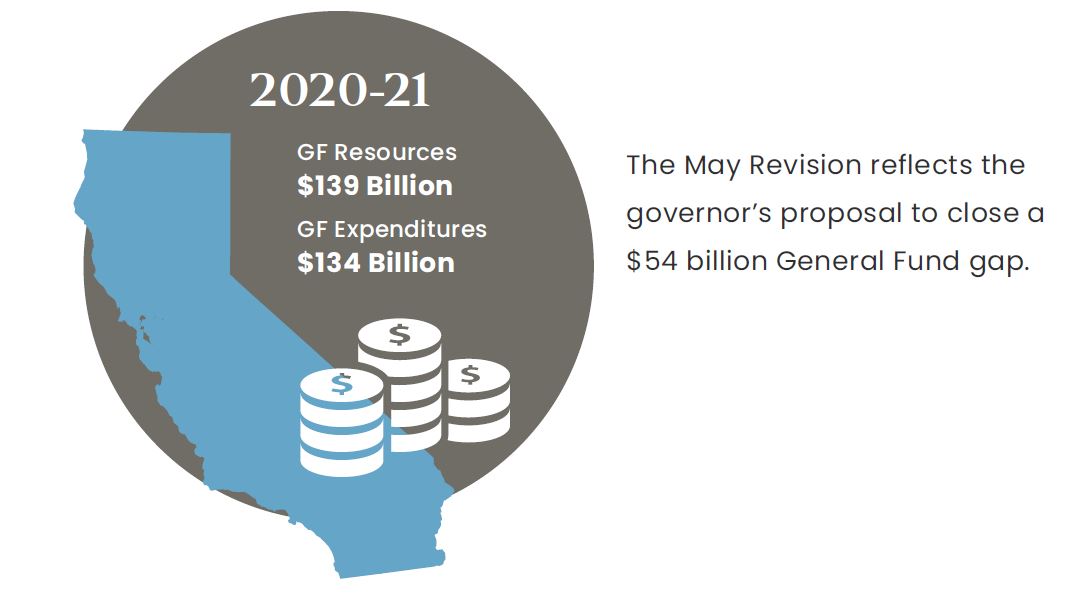

On May 14, 2020, Governor Gavin Newsom released an updated budget forecast for the 2020-21 budget, referred to as the “May Revision,” which accounts for changes in revenues and proposed changes to expenditures from the January budget. Since January, the coronavirus (COVID-19) crisis has drastically altered the state budget landscape, eliminating California’s previous surplus and creating a projected deficit of $54 billion. This deficit is due to unexpected expenses associated with COVID-19 and a 22 percent decline in revenue, based on losses in sales tax revenue (-27%), personal income tax (-25.5%), and the corporate income tax (-22.7%). The May Revision reflects total General Fund (GF) resources of $139 billion and anticipated expenditures of $134 billion.1

California’s constitution requires lawmakers to deliver a balanced budget to the governor in time for the July 1 fiscal year. This means that the state, when facing a budget deficit, must develop solutions to fill a budget gap.

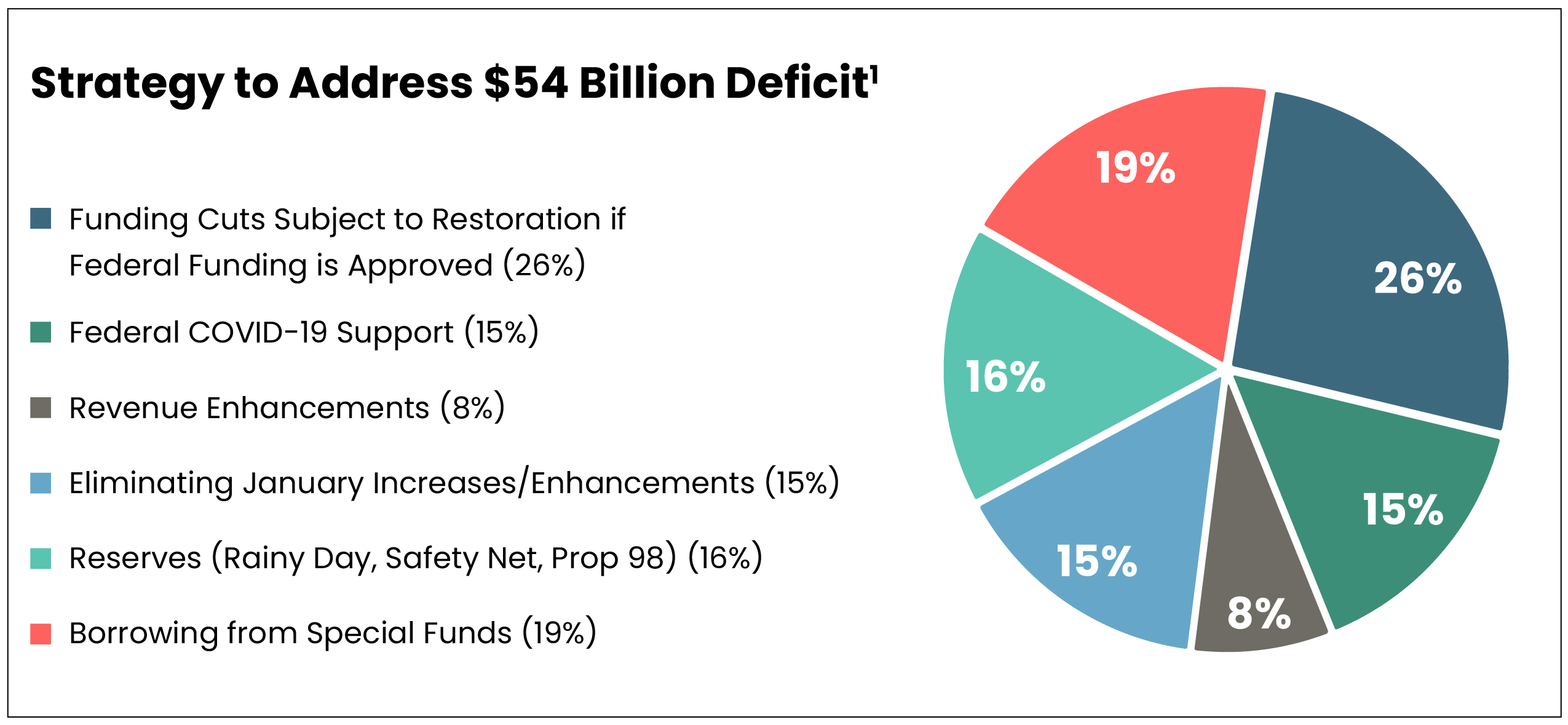

The COVID-19 crisis has fundamentally impacted California’s 2020-21 budget outlook. To address the expected budget deficit, Governor Newsom proposes to utilize state reserves, funding from the federal government for COVID-19 relief, program eliminations and reductions, as well as rescinding several proposals included in his January proposed budget.

Of the proposed cuts, $14 billion is subject to automatic restoration if the federal government passes a new stimulus package with significant funding for state governments. The remaining cuts would stay, regardless of federal support.1

Proposed Cuts and Eliminations to Programs Impacting Older Adults, People with Disabilities, and Family Caregivers

COVID-19 has overwhelmingly impacted older adults and those with complex health and daily living needs—both in terms of lives lost from the virus and proposed programmatic cuts and eliminations to balance the state budget in the May Revision.

Tables 1-2 outline proposed reductions that would weaken California’s home—and community-based service infrastructure, which allows individuals with significant needs to stay out of nursing homes. The only investment for this population is a proposed four-month rate increase for skilled nursing facilities, which have experienced a high concentration of COVID-19 cases and deaths (Table 3).

California leadership has asked for and received policy flexibilities from the federal government to address the COVID-19 crisis, and is now seeking additional revenue as part of the COVID relief package. The flexibilities have allowed home- and community-based programs to play an important role in responding to individuals’ evolving needs and changing environments by implementing process and structure changes. The flexibilities allow people to access services and care coordination via telehealth and receive support services at home that otherwise would have been provided in a congregate setting, as well as open up scope of practice for health care professionals.

| Table 1: Funding Cuts and Eliminations to Existing Programs Where Restoration Trigger Is Dependent on Federal Funding1-4 | ||

| Program & Number of Californians Affected Where Available | Proposed Budget Action | Estimated Reduction |

|---|---|---|

| Community-Based Adults Services (CBAS) Affects 36,679 Californians5 |

Eliminates the CBAS program as of July 1, 2020. | $108.4 million GF (2020-21)* $258.5 million GF (2021-22)* |

| Multipurpose Senior Services Program (MSSP) Affects 9,283 Californians6 |

Eliminates the MSSP program as of July 1, 2020. | $22.2 million GF (2020-21) $21.8 million GF (ongoing) |

| In-Home Supportive Services (IHSS) Affects 625,180 Californians under Aged, Blind, and Disabled designation7 |

Applies a 7 percent reduction in the number of hours provided to IHSS beneficiaries as of January 1, 2021. Freezes IHSS county administration funding at 2019-20 level. |

$205 million GF $12.2 million GF |

| Optional Medi-Cal Benefits | Eliminates: audiology; incontinence creams and washes; speech, occupational, and physical therapy; optician/optical lab; podiatry acupuncture; optometry; nurse anesthetist services; pharmacist services; drug screening, intervention, and treatment referrals; and diabetes prevention program services. Reduces adult dental services. |

$54.7 million GF |

| Proposition 56: Provider Payments | Eliminates Proposition 56 supplemental payments for physician, dental, family health services, developmental screenings, and non-emergency medical transportation; value-based payments; and loan repayments for physicians and dentists to support growth in the Medi-Cal program. | $1.2 billion |

* Proposed reduction of CBAS funds from both the Department of Health Care Services and California Department of Aging budgets combined.

| Table 2: Funding Cuts to Existing Programs Not Eligible for Restoration if New Federal Funding is Received 1-3 | ||

| Program & Number of Californians Affected Where Available | Proposed Budget Action | Estimated Reduction |

|---|---|---|

| Medi-Cal Eligibility Expansion for Age, Blind, and Disabled to 138 percent FPL Affects 30,000 Californians8 |

Eliminates expansion of Medi-Cal for older adults and people with disabilities with incomes between 123 percent to 138 percent of the federal poverty level (FPL). | $135.5 million ($67.7 million GF) |

| Medi-Cal Estate Recovery | Reinstates estate recovery policy that collects against all medical care incurred. | $16.9 million GF |

| California Advancing and Innovating Medi-Cal (CalAIM) | Delay implementation of the CalAIM initiative. | $695 million ($347.5 million GF) |

| Supplemental Security Income/ State Supplementary Payment (SSI/SSP) Grants Affects 1.2 million Californians9 |

Reduces the state’s SSP grant by the amount of the federal January 2021 cost-of-living adjustment for the SSI portion of the grant. | $33.6 million GF |

| Senior Nutrition Program Affects 212,725 Californians10,11 |

Reduces funding augmentation for congregate and home-delivered meal programs included in the Budget Act of 2019. | $8.5 million GF |

| Caregiver Resource Centers Affects 18,000 California families12 |

Eliminates the augmentation provided to the Caregiver Resource Centers augmentation included in the 2019 Budget Act. | $10 million GF |

| Aging and Disability Resource Centers (ADRC) | Reduces funding to partially offset the $4.2 million increase authorized under the 2019 Budget Act. | $3 million GF |

| Independent Living Centers (ILC) | Reduces funding for ILCs by 20 percent. | $2.1 million GF |

| LTC Ombudsman Program | Reduces funding for LTC Ombudsman Program by 23 percent. | $2 million GF |

| California Access to Housing and Services Fund | Eliminates proposed funding to establish a fund for developing affordable housing units, supplementing and augmenting rental subsidies, and stabilizing board and care homes. |

$750 million GF |

| Health Insurance Counseling and Advocacy Program (HICAP) | Loan from the HICAP fund to GF. | $5 million GF |

| Medi-Cal for Undocumented Older Adults | Rescinded proposal to expand Medi-Cal to undocumented older adults. | $112.7 million ($87 million GF) |

| California Cognitive Care Coordination Initiative | Eliminates one-time funds and withdraws proposal. | $3.6 million GF |

| Table 3: Proposals for Investment1 | ||

| Program & Number of Californians Affected | Proposed Budget Action | Estimated Investment |

|---|---|---|

| Skilled Nursing Facilities | Increases rates by 10 percent for four months to support COVID-19 response during pandemic. | $72.4 million GF (2019-20) $41.6 million GF (2020-21) |

The proposed program cuts and eliminations impede progress toward reaching each of the Master Plan for Aging goals, and contradict values outlined in the governor’s Executive Order.

Update on California’s Master Plan for Aging

In June 2019, Governor Newsom issued the Master Plan for Aging (Master Plan) Executive Order, outlining a framework for the plan, including establishment of a Cabinet-level workgroup, a Stakeholder Advisory Committee (SAC) and multiple subcommittee workgroups. The state developed a working framework that outlines the vision, mission, values, goals, and objectives of the Master Plan, as follows:

- Goal 1: Services & Supports. We will live where we choose as we age and have the help we and our families need to do so.

- Goal 2: Livable Communities & Purpose. We will live in and be engaged in communities that are age-friendly, dementia-friendly, and disability-friendly.

- Goal 3: Health & Well-Being. We will live in communities and have access to services and care that optimize health and quality of life.

- Goal 4: Economic Security & Safety. We will have economic security and be safe from abuse, neglect, exploitation, and natural disasters and emergencies throughout our lives.

This March, the SAC unanimously approved the final draft of the Long-Term Services and Supports (LTSS) Subcommittee report. At that time, state leaders placed a temporary hold on the stakeholder engagement process in order to fully respond to the COVID-19 public health emergency. Since that time, the COVID-19 crisis has dramatically revealed and exacerbated the shortcomings in California’s LTSS system—including system fragmentation, workforce shortages as well as numerous challenges facing residential care and skilled nursing

facility settings. The state intends to convene the SAC and resume stakeholder engagement on May 28, 2020. While the next steps in the Master Plan timeline and process are unknown, state officials have expressed continued commitment to the effort.

Ideally, the goals of the Master Plan for Aging chart a course for program planning and resource allocation over a multiyear period, and serve as guideposts for the state to view the impact of any budget proposal on this population. Instead, the proposed cuts and eliminations impede progress toward reaching each of these goals, contradict values outlined in the governor’s Executive Order on the Master Plan, and most importantly, expose low-income older adults, people with disabilities, and their family caregivers to greater harm. Now more than ever, a Master Plan is needed.

Next Steps in the Budget Process

Due to the evolving COVID-19 pandemic and budget crisis, the process is different than in years past and is subject to change. For example, the California State Assembly will meet as a Committee of the Whole to address the state budget as compared to the regular committee process. Additionally, available revenue is subject to change as the income tax filing deadline was extended to July 15, and some budget items are dependent on the federal government providing additional COVID-19 related funding. Regardless, by law, the Legislature must approve the budget by June 15. The governor has the authority to “blue pencil” (reduce or eliminate) any appropriation contained in the budget prior to signing it by July 1, 2020.13-15