California 2025-26 Enacted Budget Impact on Older Adults and People with Disabilities

summary

Governor Newsom released his revised proposal for California’s fiscal year (FY) 2025-26 budget earlier this month. Amid soaring costs, lower-than-anticipated revenues, and turbulent market conditions, the state is now confronting a projected $12 billion shortfall in its General Fund (GF).

Date Updated: 08/22/2025In June, Governor Newsom and the legislature reached an agreement on the 2025-2026 fiscal year (FY) budget. The enacted budget includes a mix of solutions to address a $12 billion General Fund (GF) shortfall. However, it does not account for the impacts of pending federal funding reductions, across various sectors but primarily in health care, in H.R. 1, the federal reconciliation bill, passed by Congress in early July.

The enacted budget preserves aging programs and services at baseline funding levels. Many of the proposed cuts from the May Revise were not included. Additionally, it protects investments in food security for older adults who are undocumented and includes new funding for housing programs aimed at serving older adults and people with disabilities. The following is a summary of the provisions that will affect older adults and people with disabilities.

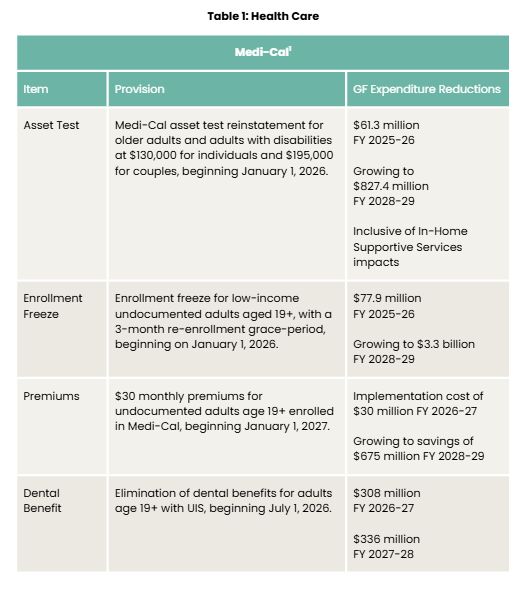

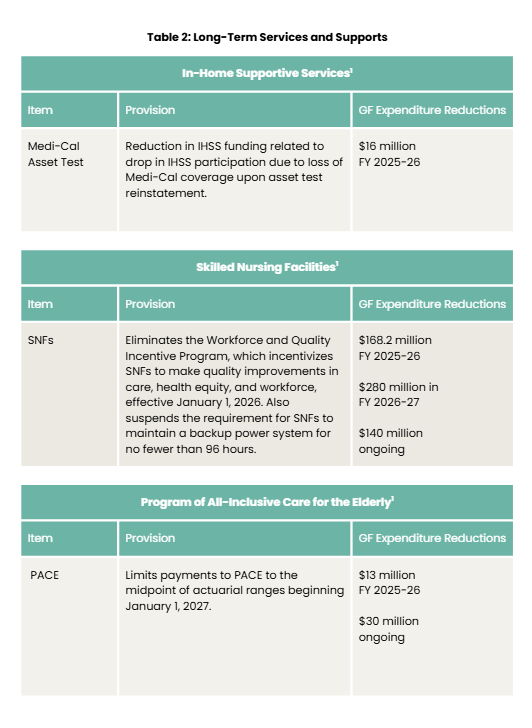

Reductions to Medi-Cal and Long-Term Services and Support

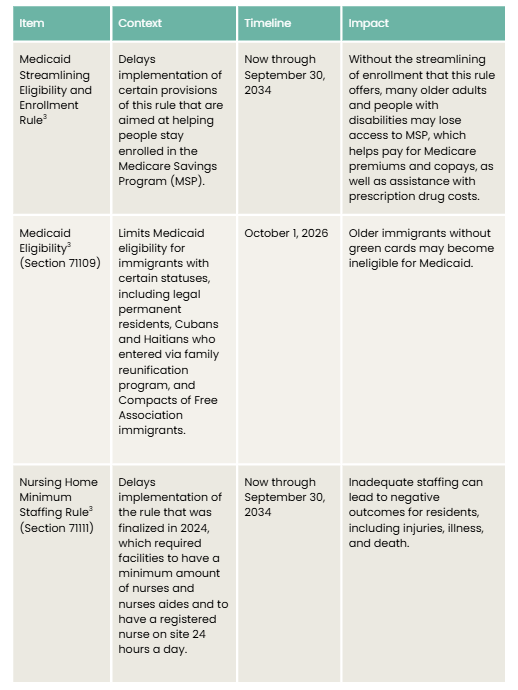

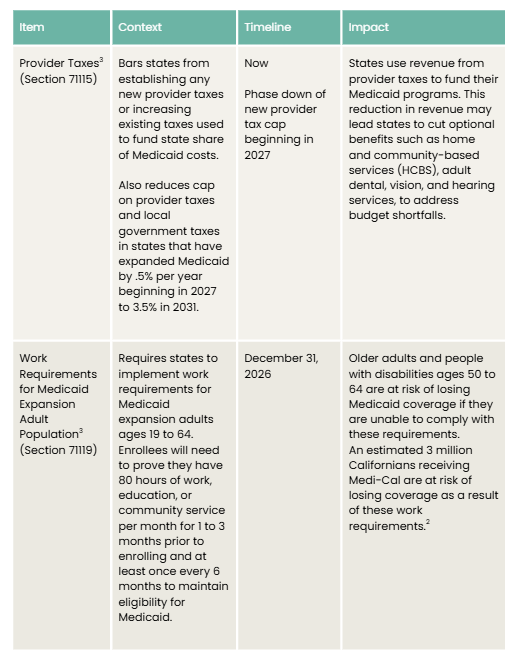

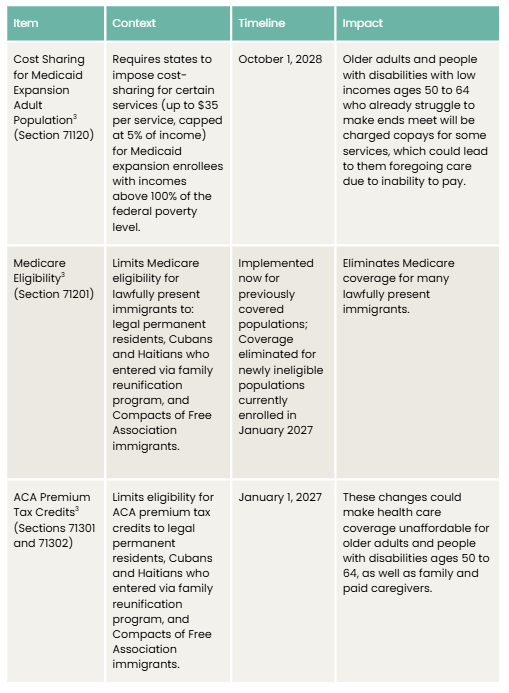

Medi-Cal provides critical health care coverage for millions of older Californians and Californians with disabilities. It also is the primary payer of long-term services and supports (LTSS), which serve people who need help with activities of daily living, such as bathing, meal preparation, and medication management. The enacted budget includes funding reductions and program changes for health care, namely for individuals with “unsatisfactory immigration status” (UIS), which includes immigrants who are undocumented and immigrants subject to the “five-year bar”. Additionally, while the enacted budget did not include many of the concerning reductions in LTSS that were proposed in the May Revise, it did include reductions impacting In Home Supportive Services (IHSS), skilled nursing facilities (SNFs), and the Program of All-Inclusive Care for the Elderly (PACE). These reductions constitute a reversal of key commitments the state made under the banner of the Master Plan for Aging, including repealing the Medi-Cal asset test limit (which considers certain assets when determining Medi-Cal eligibility) and expanding Medi-Cal to all older adults, regardless of immigration status. Table 1 shows Medi-Cal funding and program changes and Table 2 shows LTSS-related reductions included in the enacted budget.

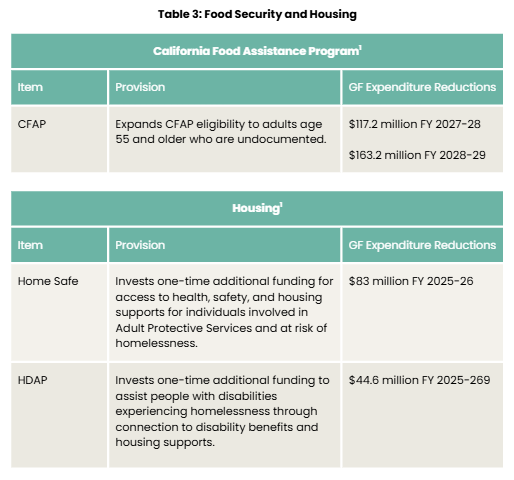

Investments in Food Security and New Housing Funding

The enacted budget commits to future investment in the California Food Assistance Program (CFAP) to expand eligibility to adults age 55 and older who are undocumented. The “trigger” making the expansion contingent on availability of future funding that was proposed in the May Revise was rejected. Additionally, the enacted budget includes new, one-time funding for the Home Safe Program and the Housing and Disability Advocacy Program (HDAP), the only two housing programs focused on serving older adults and people with disabilities. The additional funding will ensure that these programs continue and can expand their reach to serving more older adults and people with disabilities. Table 3 shows the investments in food security and housing in the enacted budget.

H.R. 1 Impacts

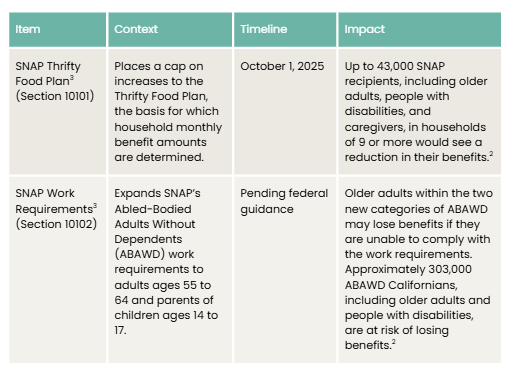

The federal reconciliation bill, H.R. 1, was enacted in early July. The bill includes dramatic reductions in funding that will impact health care access and food assistance for older adults and people with disabilities. Indeed, the California Health and Human Services Agency estimates nearly $34 billion in available funding is at risk due to various provisions of H.R. 1.2 While some of the reductions do not impact people age 65 and older, the implementation of work requirements and changes to eligibility for Affordable Care Act (ACA) tax credits will impact older adults age 50 to 64, as well as family and paid caregivers. As previously mentioned, the California final budget does not account for impacts from reductions in federal spending for key programs, including Medicaid and the Supplemental Nutrition Assistance Program (SNAP). The California legislature could address the budget impacts of H.R. 1 as early as September, either through a special session or additional budget bills. The following are key reductions that will impact older adults and people with disabilities in California.

1. California Office of the Governor. (2025). California State Budget 2025-26. Retrieved July 23, 2025, from https://ebudget.ca.gov/2025- 26/pdf/Enacted/BudgetSummary/FullBudgetSummary.pdf

2. California Health and Human Services. (2025). Navigating Federal Cuts to Health and Human Services in California: A Presentation with CalHHS. Retrieved July 23, 2025, from https://www.youtube.com/watch?v=cPgC0d_EqUo

3. P.L. 119-21/H.R.1. Retrieved August 1, 2025, from https://www.congress.gov/bill/119thcongress/house-bill/1/text

Continue Reading

This policy brief provides an introduction to The SCAN Foundation’s CLASS Technical Assistance Brief Series, which explores many of the critical issues to be considered for successfully implementing CLASS.

This policy brief describes the broad needs of individuals with disability and the wide range of supportive and environmental solutions that can allow for the most independent living possible. It suggests how findings on social and environmental supports for individuals with disability can inform implementation of CLASS.

This policy brief provides background on the historical development of benefit eligibility triggers in the private long-term care insurance market. Understanding how these triggers came into being can provide important information to those charged with implementing the CLASS Plan.